The IRS also reminds organizations that whenever they receive a denial of an ERC claim they've solutions accessible to file an administrative enchantment by responding again into the handle to the denial letter.

The IRS is concerned about a lot of poor ERC claims and is also intently reviewing tax returns that declare the credit rating. The IRS urges taxpayers to review their claims and promptly take care of incorrect ones.

When you’ve been assigned an examiner, communicate with your examiner regarding how to submit your withdrawal ask for on to them.

The IRS hasn't paid out your claim, or the IRS has compensated your assert however, you haven’t cashed or deposited the refund Examine.

You paid out capable wages only to personnel who weren't offering expert services, If you're a substantial suitable employer;

The employee retention tax credit is a totally refundable tax credit history you don’t really have to pay back again. This refund is lasting, and you receive to keep whatever you get.

Alternatively, you could contain the overstated wage expenditure amount as gross cash flow with your profits tax return for your tax 12 months any time you gained the ERC.

When the IRS continues to be analyzing the outcomes of this primary substantial wave of disallowances in 2024, early indications point out mistakes are isolated.

Nevertheless, if an appropriate governing administration authority – like a state governor – issued an buy that manufactured OSHA suggestions obligatory, the employer might then be able to claim the ERC.

Companies nevertheless have time to claim the ERC, Even though that might modify Together with the proposed legislation. Paychex will help them realize what’s necessary to Examine on their eligibility.

Tension to say the credit for the reason that “every single company qualifies” or because a business like yours received the here credit rating. Eligibility for the ERC is elaborate and depending on each small business’s details and situation.

If you are a new business enterprise, the IRS lets the usage of gross receipts for your quarter in which you begun small business being a reference for just about any quarter which they don't have 2019 figures simply because you were not nonetheless in organization.

Many employers ponder if they might nonetheless declare ERTC funding whenever they’ve taken out a PPP personal loan, and The solution is yes. You'll be able to declare ERC cash as long as your company meets the eligibility needs shown higher than.

The quantity of your ERC lowers the quantity that you will be permitted to report as wage price on your own money tax return with the tax year by which the competent wages had been paid out or incurred.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Jonathan Taylor Thomas Then & Now!

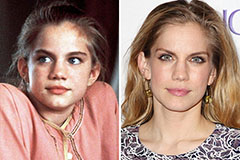

Jonathan Taylor Thomas Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now!